1. What Does “No Deductible or Copay” Mean?

-

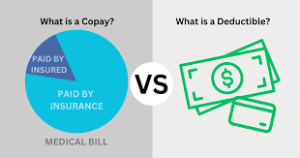

A no‑deductible plan means your insurance begins covering services immediately—there’s no threshold you must meet first investopedia.com+4wealthoramoney.com+4reddit.com+4livewell.com+4forbes.com+4newhealthinsurance.com+4.

-

A no‑copay plan eliminates the fixed fee (e.g., $20 per visit) you’d normally pay for care; sometimes you still pay coinsurance (a percentage) .

Together, they offer first-dollar coverage, where the insurer starts contributing from the very first dollar of care—but these perks tend to come at a price: higher premiums .

2. Who Benefits Most from These Plans?

You should consider a no‑deductible/no‑copay plan if:

-

You need frequent medical attention—regular check-ups, chronic condition management, or ongoing specialist visits sfchronicle.com+15valuepenguin.com+15forbes.com+15newhealthinsurance.com+5myscheme.org.in+5reddit.com+5.

-

You prefer predictable costs—knowing exactly what each visit will cost can ease budgeting concerns .

-

Cash flow is limited—paying slightly more in premiums might relieve stress over surprise medical bills myscheme.org.in+2livewell.com+2reddit.com+2.

-

You value simplicity—no waiting to meet a deductible, no confusing out-of-pocket thresholds acko.com+15livewell.com+15reddit.com+15.

These plans are ideal for individuals with recurring healthcare needs or those who dislike billing surprises.

3. The Trade-offs: Higher Premiums & Potential Limits

-

Premium costs are 15–30% higher than comparable plans with deductibles reddit.com+2wealthoramoney.com+2forbes.com+2reddit.com+5newhealthinsurance.com+5reddit.com+5.

-

Some plans may include coinsurance, so you still pay a portion (e.g., 20–40%) of costs after services begin .

-

Network restrictions are common—you may only get full benefits when using in-network providers livewell.com+1newsroom.cigna.com+1.

-

Few ACA marketplace options: fewer than 40 no‑deductible plans exist nationally valuepenguin.com+3forbes.com+3livewell.com+3.

-

Typically no HSA eligibility, as those require high-deductible plans—meaning you lose some tax-advantages en.wikipedia.org.

4. Examples of Plans Offering These Features

Here are some common plans known for zero-cost sharing attributes:

▪️ Cigna Marketplace Plans

Cigna offers individual/family plans in 11 states that may include $0 copays and even $0 deductibles on various benefits—such as virtual care and insulin acko.com+15newsroom.cigna.com+15en.wikipedia.org+15.

▪️ Blue Cross Blue Shield

BCBS provides zero-deductible options, with broad networks and preventive care coverage included newhealthinsurance.com+5newhealthinsurance.com+5livewell.com+5.

▪️ Aetna & Kaiser Permanente

-

Aetna offers $0 deductible plans, often with rich networks and added perks sfchronicle.com+8newhealthinsurance.com+8valuepenguin.com+8.

-

Kaiser Permanente’s Gold HMO sometimes features $0 deductible options, with strong quality ratings joinditto.in+3wealthoramoney.com+3investopedia.com+3.

▪️ UnitedHealthcare Choice Plus

A hybrid plan: low deductible (e.g. $1,000) and sometimes $0 copays for primary and virtual care investopedia.com.

5. Choosing the Right Plan: What to Compare

1. Premiums vs. Usage

-

If you expect high healthcare use, higher premiums may be offset by savings on deductibles/copays .

-

If you’re generally healthy, a high-deductible plan plus an HSA may be cheaper.

2. Coinsurance and Out-of-Pocket Max

-

Understand any remaining coinsurance; even no-deductible plans may include cost-sharing verywellhealth.com+2forbes.com+2newhealthinsurance.com+2.

-

Know the plan’s annual out-of-pocket max—once reached, you’re fully covered.

3. Formulary & Prescription Coverage

-

Check drug tiers and copays; $0 doctor visits can be overshadowed by high drug costs.

4. Network Breadth

-

Confirm that your doctors, specialists, and preferred hospitals are in-network—especially crucial for HMO-style plans forbes.com.

5. Ancillary Benefits

-

Virtual care, mental health, wellness incentives—these can add significant value .

6. Plan Type & Simplicity

-

HMOs often have no copay structure and are simpler but restrict you to one network .

6. How to Evaluate Your Situation

-

Estimate your annual medical usage—visits, medications, tests.

-

Calculate total cost for both plan types:

-

Premium + copays/coinsurance vs. lower premium + deductible/out-of-pocket.

-

-

Use real-world examples: Check premium data—e.g., $586/month for a no-deductible ACA plan vs. $509 average forbes.com.

-

Review provider access and formularies—don’t ignore fine print.

7. Real-World Patient Perspectives

From Reddit discussions:

“Copay Focus seems like a clear win… in most of these larger cost scenarios… you hit the OOP max quickly and then insurance pays 100%” en.wikipedia.org+6reddit.com+6reddit.com+6.

And:

“If it lists ‘0% coinsurance after deductible’… premium could be less, but deductible could be higher” verywellhealth.com+15reddit.com+15investopedia.com+15.

These voices highlight the importance of balancing premiums, deductibles, and coinsurance based on your healthcare profile.

8. When to Consider No-Deductible/No-Copay

-

Chronic conditions or ongoing specialist visits

-

Families with young children needing routine care

-

Retirees or those on fixed income needing predictability

-

Care managers, pregnant individuals, or those in active wellness programs using plan incentives

9. Step-by-Step Guide to Choosing Your Plan

-

List your anticipated healthcare usage in the coming year.

-

Get quotes for at least three plans with zero deductibles/no copays.

-

Calculate projected total costs (premium + cost-sharing).

-

Check network and drug formulary fit.

-

Assess additional benefits like telehealth, fitness, or chronic care programs.

-

Run a sensitivity analysis—what if you need more/less care?

-

Reevaluate annually as health, life stage, premiums, and plans evolve—especially at open enrollment reddit.com+6apnews.com+6wealthoramoney.com+6reddit.commyscheme.org.in+1newsroom.cigna.com+1joinditto.in+1wealthoramoney.com+1verywellhealth.com+5livewell.com+5sfchronicle.com+5wealthoramoney.com.

Final Thoughts

Plans with no deductible or copay offer powerful simplicity and predictability—but at a premium. They’re ideal for:

-

Frequent medical users

-

Families needing many services

-

Individuals wanting peace of mind and fewer out-of-pocket surprises

However, if you’re generally healthy, a high-deductible plan (with an HSA) may be a smarter financial choice.

Summary: When to Go Zero Cost Sharing

| Situation | Best Plan Type |

|---|---|

| Chronic illness or regular care needed | No-deductible/no-copay plan |

| Value ease and predictable costs | Copay-focused or managed care plan |

| Low or infrequent healthcare needs | HDHP + HSA |

Ultimately, align your monthly budget, expected usage, and comfort with cost-sharing to find the right fit.