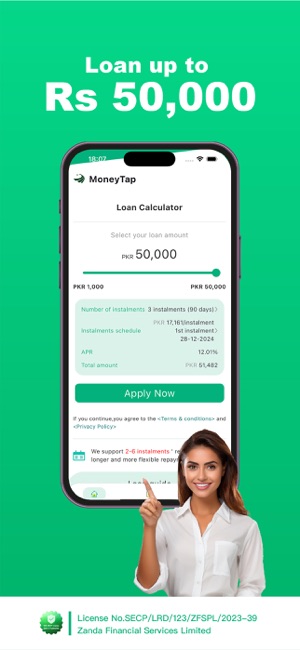

✅ What is MoneyTap?

MoneyTap is India’s first app-based credit line platform that provides instant personal loans in a flexible, revolving format. It allows users to borrow money on demand, only pay interest on the amount used, and convert borrowed funds into affordable EMIs. With quick digital approval, minimal documentation, and credit limits up to ₹5,00,000, MoneyTap is ideal for salaried and self-employed individuals looking for quick credit.

MoneyTap isn’t a typical loan app—it functions like a credit card + personal loan hybrid, giving you more control and flexibility in how you use and repay the borrowed amount.

📲 MoneyTap App Download Links

🔗 Android (Google Play Store):

👉 Download MoneyTap App

🔗 iOS (Apple App Store):

👉 Download on iPhone

🌐 Official Website:

👉 https://www.moneytap.com

🏦 How Does MoneyTap Work?

-

Apply Online or via App

-

Complete the registration and eligibility check.

-

-

Credit Line Approval

-

If approved, you get a credit line up to ₹5 lakhs.

-

-

Borrow Any Amount Anytime

-

Withdraw as low as ₹3,000 from your credit limit.

-

-

Flexible EMIs

-

Choose repayment tenure from 2 to 36 months.

-

-

Revolving Credit

-

Repay and reuse the credit limit without reapplying.

-

Unlike a one-time loan, MoneyTap gives you a continuous borrowing facility—interest is charged only on the amount used, not the entire limit.

📌 Key Features of MoneyTap

-

💸 Instant Credit Limit: ₹35,000 to ₹5,00,000

-

🔁 Revolving Credit Line: Use, repay, reuse anytime

-

📉 Interest Rates: From 13% to 24% per annum

-

📆 EMI Tenure: 2 months to 36 months

-

📱 Fully Digital Application: Minimal documentation

-

💳 Zero Usage = Zero Interest

-

🛍️ Credit Card Facility (in select cities): Powered by RBL Bank

-

🔒 Safe & Secure: 128-bit encryption and RBI-compliant NBFCs

📝 Eligibility Criteria

| Criteria | Details |

|---|---|

| Age | 23 to 55 years |

| Income | ₹20,000/month (net salary) |

| Location | Available in 80+ Indian cities |

| CIBIL Score | Minimum 650 preferred |

| Employment | Salaried or self-employed |

📄 Documents Required

-

✅ PAN Card

-

✅ Aadhaar Card / Voter ID / Driving License

-

✅ Recent Salary Slips / Bank Statements (last 3 months)

-

✅ Selfie for KYC

-

✅ Cancelled cheque (for eMandate)

💰 Loan Types on MoneyTap

1. Credit Line Loan

-

Pre-approved credit line (up to ₹5,00,000)

-

Use partially or fully as needed

-

Repay in easy EMIs

2. Personal Loan (One-time)

-

Option to convert part of your credit line into a full loan

-

Tenure from 6 to 36 months

-

Ideal for education, medical, rent deposits, etc.

3. EMI Card (in select cities)

-

MoneyTap RBL Credit Card for in-store and online purchases

-

EMI conversion at checkout

🎯 Use Cases of MoneyTap Credit

-

👨⚕️ Medical Emergencies

-

🎓 Tuition Fees / Certification Courses

-

📱 Buy Mobile or Laptop on EMI

-

🏡 Pay Rent or Deposit

-

💍 Wedding Expenses

-

🛫 Travel or Vacation

-

🚗 Vehicle Repairs

💵 Interest Rates & Charges

| Fee Type | Charges |

|---|---|

| Interest Rate | 13% – 24% p.a. (monthly reducing) |

| Processing Fee | 1.5% – 2% of approved amount |

| Late Payment Fee | ₹350 + GST (per missed EMI) |

| Prepayment Charges | ₹0 (no charge for early repayment) |

| Annual Maintenance | ₹199 (for cardholders) |

📱 Step-by-Step: How to Apply on MoneyTap

-

Download the app from Play Store or App Store

-

Register using your mobile number

-

Complete KYC and submit income documents

-

Get Credit Line Approved (up to ₹5,00,000)

-

Withdraw Funds as needed into your bank

-

Convert to EMIs with flexible tenure

-

Repay via auto-debit or manual payment

💬 MoneyTap Customer Support

-

📞 Phone: Not available publicly; app-based support preferred

-

📧 Email: hello@moneytap.com

-

🌐 Contact: https://www.moneytap.com/contact-us

-

📍 Address: Based in Bangalore, India

-

⏰ Support Hours: Mon–Sat, 10 AM – 6 PM

📊 Benefits of Using MoneyTap

-

✅ Flexible Loan Amounts – Take only what you need

-

✅ No Re-application Needed – One-time KYC

-

✅ Zero Interest Until You Use It – Pay interest only when you withdraw

-

✅ Prepayment Friendly – Repay early with no extra charges

-

✅ Good for Emergency Use – Medical, rent, travel, etc.

-

✅ In-app Loan Tracker – Know your limit, usage, EMIs, and due dates

-

✅ Improves Credit Score – On-time payments reported to CIBIL

🧠 Tips for Getting Approved

-

Use your official salary account for faster verification

-

Ensure your CIBIL score is above 650

-

Upload clear and valid documents

-

Keep your PAN and Aadhaar updated with the same mobile number

-

Borrow only what you can repay comfortably

📥 Download MoneyTap App Now

🔗 Download for Android

🔗 Download for iOS

🌐 Visit Official Website

📝 Conclusion

MoneyTap is revolutionizing how Indians borrow money by offering smart, flexible, and transparent credit lines. Unlike traditional personal loans, you only pay interest on what you use, and you can borrow anytime without reapplying. It’s a modern financial tool ideal for emergencies, lifestyle spending, and everyday needs.

If you’re looking for a mix of credit card convenience and personal loan flexibility, the MoneyTap Credit Loan App is your all-in-one solution.